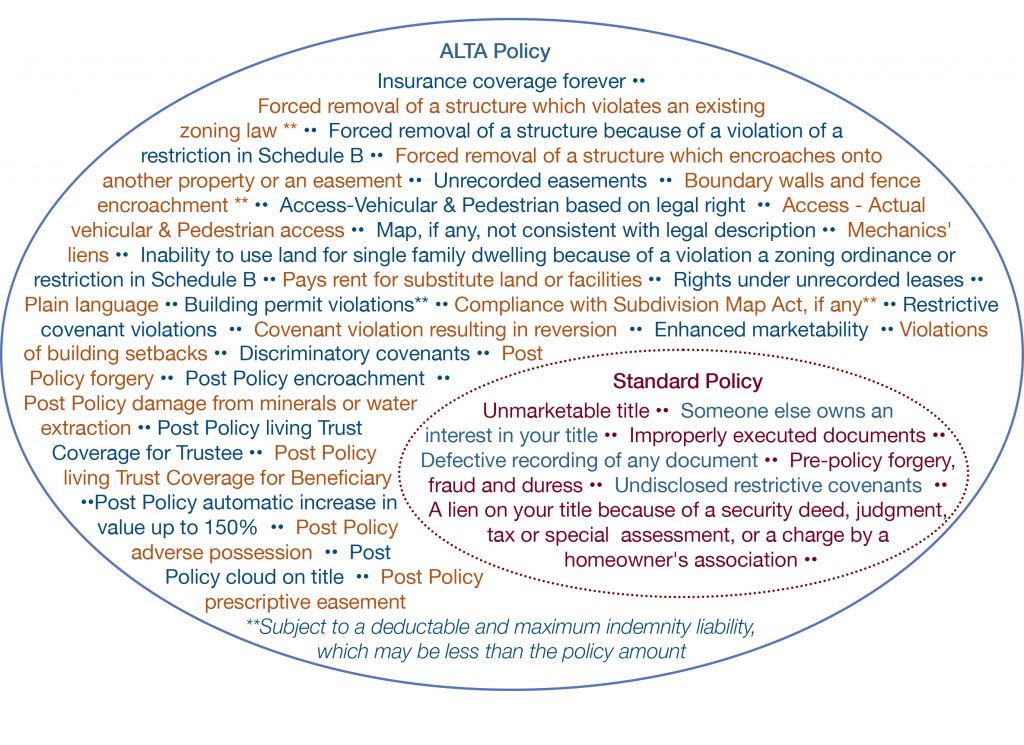

An Extended Coverage Policy of Title Insurance Covers

The CLTA California Land Title Association policy insures the property owner and the ALTA American Land Title Association is an extended coverage policy that insures the lender against possible unrecorded risks excluded in the CLTA policy. Insurance such as car life health etc protects against potential future events and is paid for with monthly or annual premiums.

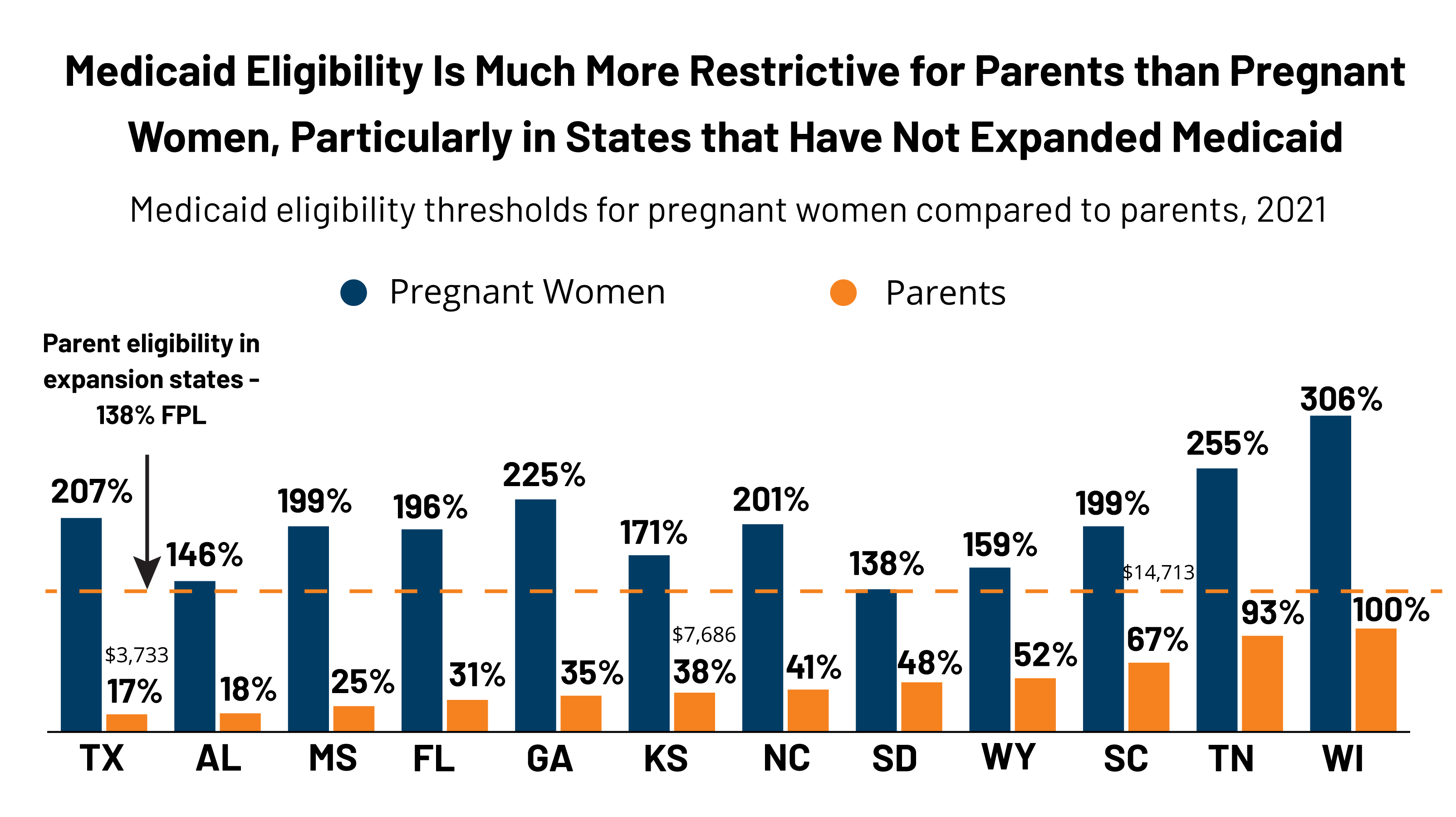

Postpartum Coverage Extension In The American Rescue Plan Act Of 2021 Kff

Coverage than prior policy versions.

. Although title insurance historically has emphasized risk elimination over risk assumption the 2006 ALTA policies provide a bit more casualty coverage than prior forms5 Neverthe less this comparison also will show that the 2006 ALTA policies may clarify coverage more than they actually increase it. How to determine whether you need enhanced title insurance when buying a home Some title companies may offer upgraded coverage including coverage over building violations zoning violations and. Title insurance doesnt insure against fire flood theft or any other type of property damage or loss.

Silent off-record liens such as mechanics or estate tax liens. Title insurance is a policy that covers third-party claims on a property that dont show up in the initial title search and arise after a real. Question An extended coverage policy of title insurance covers all of the following EXCEPT O a.

What it doesnt cover. B off record easements. The lenders title insurance policy only covers claims that affect the lenders loan.

Deed to land with buildings encroaching on land of another. The CLTAALTA Homeowners Policy of Title Insurance is distinct from both the CLTA and ALTA forms as it may insure only a one to four unit residential structure where the insured is a natural person. Keep your policy even if you transfer your title or sell the property.

Silent off-record liens such as mechanics or estate tax liens. In any real estate transaction the title company runs a public records search to ensure that the home being purchased is free and clear of any liens or ownership disputes. The CLTA title insurance coverage remains active until the property is sold while the ALTA lenders policy remains in place until.

Owners coverage protects the buyer of the propertys. Standard coverage refers to the policy that insures against basic risks including defects that are ascertainable from the public records and risks of forgery competency and capacity. An extended coverage policy may be requested to protect against such additional defects as.

Question An extended coverage policy of title insurance covers all of the following EXCEPT O a coverage offered by the standard policy. As escrow fails to close. The escrow holder should.

A lenders title policy protects the lenders interest up to the amount of the loan. Almost all lenders require the borrower to. If your real estate agent mortgage broker etc recommends a title agency to you ask whether they have a financial interest in the agency.

Off-record matters such as claims for adverse possession or prescriptive easement. Title insurance provides protection for a one-time premium for an indefinite period of time from future losses because of events that have already occurred eg. Most residential title insurance policies extend coverage to your heirs through a will to a spouse in the event of a divorce or to children when the property is transferred from parents to children for nominal consideration.

The title insurance premium is not negotiable. Title insurance is often characterized as providing either standard coverage or extended coverage. It also covers losses and damages suffered if the title is unmarketable.

D physical condition of the property. Problems that occur after the. Orights of parties in possession.

There are two types of title insurance. Deed to land with buildings encroaching on land of another. The average cost of title insurance is around 1000 per policy but that amount varies widely from state to state and depends on the price of your home.

Title insurance premiums can vary from a. Title insurance doesnt protect against boundary disputes with your neighbor unless you buy an endorsement adding that coverage. Extended coverage refers to the policy that insures in addition against defects not.

Both the buyer and seller demand the purchase deposit be turned over to them. Coverage changes may result in premium changes. Although these are the basic coverages expanded forms of residential owners policies exist that cover additional items of loss.

You pay for title insurance only once when you buy the policy unless you decide later to add more coverage. The policy also provides coverage for loss if there is no right of access to the land. If someone sues with a claim against your home you are the first person responsible.

To protect your equity in the event of a title problem you may want to purchase an owners title insurance policy. Extended Title is an extended coverage because there are many things not covered by basic title insurance policies Medical Covers illnesses and lengths of stay not covered by the basic medical or health care policy Dental will help pay for some or partially covered dental surgeries. A title policy wont cover.

Lender extended coverage policies of title insurance cover all EXCEPT a forgery. Residential title insurance coverage lasts as long as you own the property. Coverage lasts as long as you or your heirs own the land and may last forever for any title warranties made when you sell the property.

Lenders title insurance and owners title insurance including extended policies. Off-record matters such as claims for adverse possession or prescriptive easement. O d liens placed by the insured.

Because of this title insurers eliminate risks and prevent losses in advance through extensive searches of public records and thorough. An extended coverage policy may be requested to protect against such additional defects as. Make sure you know what your title insurance policy does and does not cover before you purchase it.

Title insurance covers any underlying issues with a home or propertys title that the title company may have missed during the home-buying process. ALTA Extended Coverage If you choose to have a survey done of your property you can also choose to purchase an ALTA extended coverage policy which is. A homeowners insurance policy covers these losses.

It is often referred to as an expanded coverage policy. When you are concerned that there are some problems to the title that may occur after the policys effective date. A title insurance policy insures against events that occurred in the past of the real estate property and the people who owned it for a one-time premium paid at the close of the escrow.

Some instances where you should consider extended title insurance coverage would be. D physical condition of the property. The main advantage of an extended title insurance cover is that it will also pay for post-policy risks and claims.

Home Buyers Cover Your Assets Choosing Between Standard And Extended Title Insurance Deeds Com

Why You Not Buy Vacant Home Insurance Geico Vacant Home Insurance Home Insurance Quotes Home Insurance

Happy Mother S Day Health Milestones That All Parents And Our Nation Should Celebrate Cen Health Care Coverage Health Insurance Plans Child Health Insurance

The Difference Between A Clta And Alta Title Policy Schorr Law

Protect Your Commercial Property With Title Insurance By Getting An Owner S Policy Title Insurance Title Commercial Property

Geico Vacant Home Insurance Home Insurance Home Insurance Quotes Homeowners Insurance

Ever Wonder That Your Title Insurance Covers We Have The Answers For You Firstaz Title Marketin Title Insurance Homeowners Insurance Home Insurance Quotes

What Is An Alta Extended Title Policy Geraci Law Firm

Insurance Ad Lighthouse Thermometer Litho In Usa Glco Of Etsy Lighthouse Decor Vintage Thermometer Vintage Beach

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

Homeowners Insurance Guide A Beginner S Overview

Homeowners Insurance Cover Compare Home Insurance Options And Deals Homeowners Insurance Coverage Home Insurance Quotes Homeowners Insurance

Pin By The Project Artist On Understanding Entrepreneurship Understanding Writing No Response

/GettyImages-1053743626-21039c92e4b44b828f71db2c1d27a9a2.jpg)

Comments

Post a Comment